An estimated 90% of U.S. millionaires become wealthy through real estate.

There are many ways to invest in real estate

with many different opinions.

Seek help from a professional before investing.

-

BRRRR

This method combines the ‘Buy & Hold’ with the ‘Flip’ method by buying a distressed property and rehabbing it but keeping it to use as a rental.

-

Buy & Hold

An investor buys a property with the intent to hold onto it for an extended period of time, while renting it out to produce cash flow before selling in the future.

-

Flip Houses

An investor buys a distressed property for cheap and renovates it as quickly as possible. The investor then re-sells the property for a profit.

-

Wholesale

A wholesaler acts as a middleman by finding a property, getting it into contract, and then selling the property to an end buyer for a small fee.

-

REIT

A Real Estate Investment Trust is an investment vehicle organized as a trust, containing at least 100 members, with the members being beneficiaries.

Key Investing Terms

-

All the income generated from the property in an ideal situation with no losses or vacancies and before subtracting any expenses

-

Fixed expenses - operating expenses that do not vary based on occupancy (ex. taxes & insurance)

Variable expenses - operating expenses that may vary with occupancy (ex. repairs/maintenance, income taxes, management)

Capital expenses - reserves for replacements (ex. roof or HVAC)

-

NOI is the income leftover after all vacancies, losses, and expenses are deducted from the potential gross income.

NOI does not take the financing of a property into consideration.

-

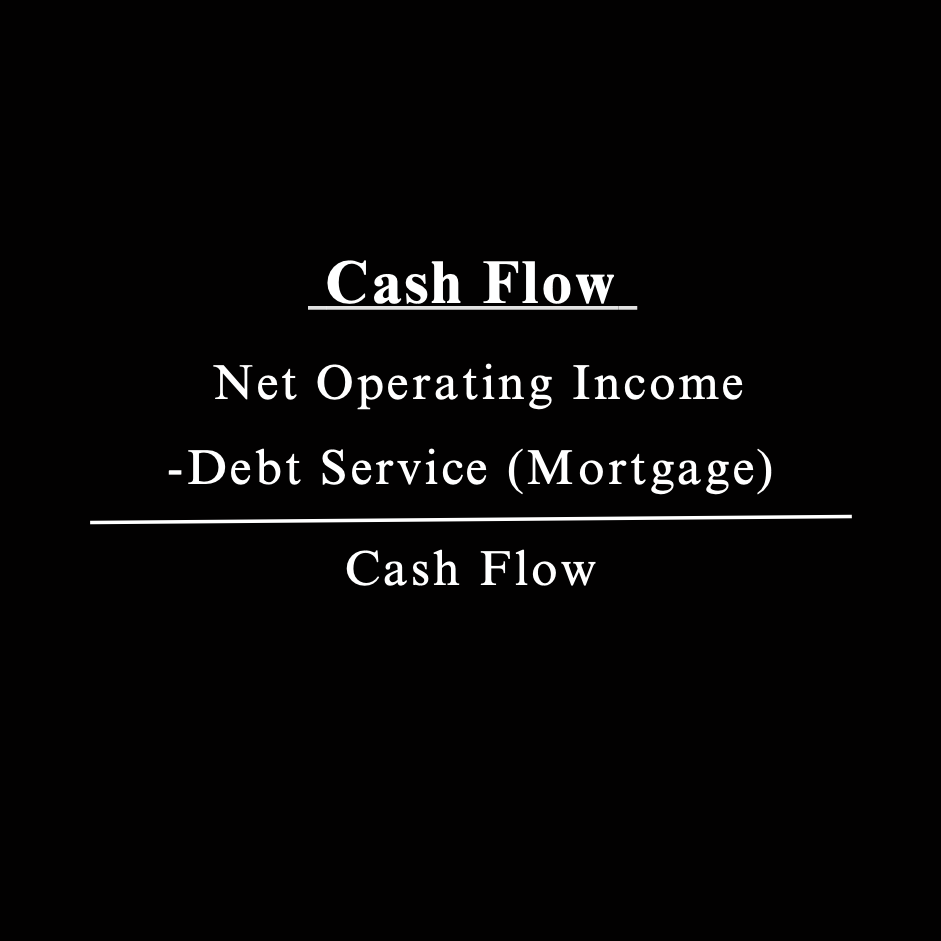

The cash netted after subtracting the debt service from the Net Operating Income

-

The ratio of income produced annually (cash flow) by the cash used to acquire the property (down payment + closing costs).

Note: cost of the property here is not the full purchase price - it is only the money used upfront to purchase the property

-

The amount of money paid at regular intervals toward reducing the principal and interest owed on a debt.

-

A rate of return found dividing the NOI by the purchase price (expressed as a percentage)

*Can be misleading because it does not account for debt service